The Ultimate Guide to Bookkeeping Companies: Enhancing Financial Services

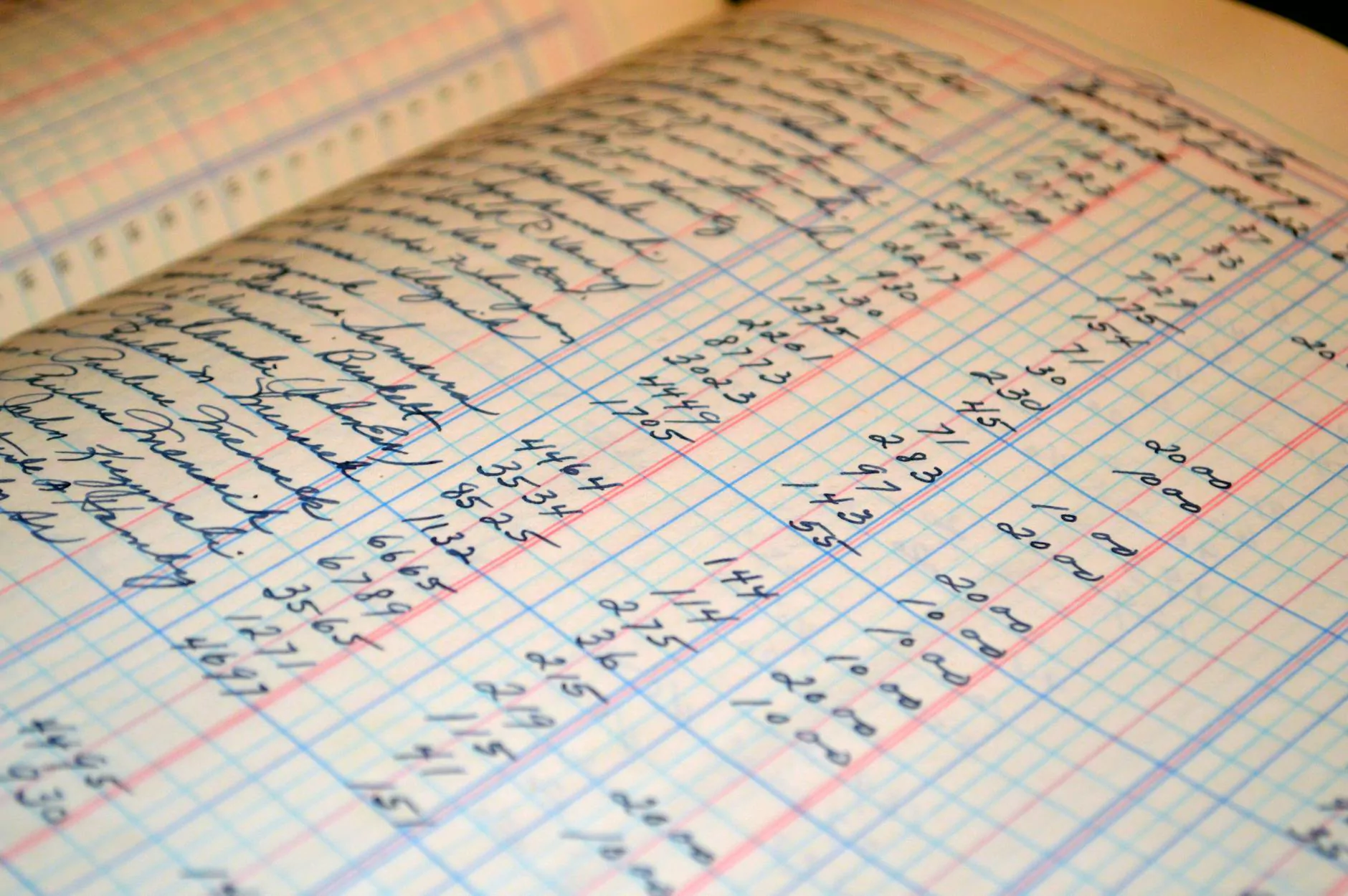

Welcome to the world of business finance where precise bookkeeping is the backbone of success. In today's competitive market, organizations strive to maintain accurate records of their financial transactions, and this is where bookkeeping companies play a crucial role.

Understanding Bookkeeping Companies

Bookkeeping companies are specialized firms that offer financial services, financial advising, and expertise in accounting practices. They are dedicated to helping businesses of all sizes manage their financial data efficiently and effectively. By outsourcing bookkeeping tasks to these professionals, companies can focus on their core operations and strategic growth.

Benefits of Engaging Bookkeeping Companies

Utilizing the services of bookkeeping companies brings a plethora of advantages to businesses. Here are some key benefits:

- Accuracy: Bookkeeping companies ensure that financial records are maintained accurately, minimizing errors and discrepancies.

- Time-Saving: By delegating bookkeeping tasks, businesses save time which can be allocated to more critical areas of operation.

- Expertise: These companies employ skilled professionals who possess in-depth knowledge of financial practices and regulations.

- Cost-Effective: Outsourcing bookkeeping is often more cost-effective than hiring an in-house team.

- Compliance: Bookkeeping companies help businesses stay compliant with tax laws and financial regulations.

- Insightful Reports: They provide valuable insights through detailed financial reports, aiding in decision-making processes.

Enhancing Financial Services with Bookkeeping Companies

For businesses looking to enhance their financial services, partnering with bookkeeping companies is a strategic move. These firms offer a wide range of services that can transform the way companies manage their finances, including:

- Payroll Management: Ensuring accurate and timely payroll processing for employees.

- Accounts Payable and Receivable: Managing invoices, payments, and receivables efficiently.

- Financial Reporting: Generating detailed financial reports that provide insights into the company's financial health.

- Budgeting and Forecasting: Assisting in creating budgets and forecasts to aid in financial planning.

- Tax Preparation: Helping businesses prepare and file taxes accurately and on time.

Collaborating with Accountants for Comprehensive Financial Support

In addition to bookkeeping services, businesses can benefit from collaborating with accountants who bring a higher level of financial expertise and strategic planning. Accountants work closely with bookkeeping companies to provide comprehensive financial support, including:

- Tax Planning: Strategizing to minimize tax liabilities and maximize returns.

- Auditing Services: Conducting audits to ensure financial accuracy and compliance.

- Financial Analysis: Offering insights into financial performance and areas for improvement.

- Business Consulting: Providing strategic advice for business growth and financial stability.

Final Thoughts

Bookkeeping companies, along with the support of accountants, play a vital role in helping businesses streamline their financial operations, improve decision-making, and achieve long-term success. By entrusting these professionals with financial advising and accounting tasks, businesses can focus on their core objectives and drive growth in today's dynamic business landscape.

Overall, bookkeeping companies offer a valuable service that can transform the financial health and sustainability of businesses. Embracing their expertise and leveraging their services can be a game-changer for organizations seeking to thrive in the competitive marketplace.